The Essential Beginner’s Guide to Establishing an Offshore Trust

The Essential Beginner’s Guide to Establishing an Offshore Trust

Blog Article

Discover the Services Supplied by Offshore Trusts and Their Effect on Asset Administration

When you think about property management, overseas depends on might not be the very first point that enters your mind, but their prospective can not be overlooked. These frameworks supply unique benefits that can improve your economic technique, from privacy to tax obligation optimization (offshore trust). As you explore the various services they supply, you'll locate insights that could reshape exactly how you come close to wide range preservation and protection. What's more, the ideal overseas trust fund framework could hold the key to protecting your monetary future.

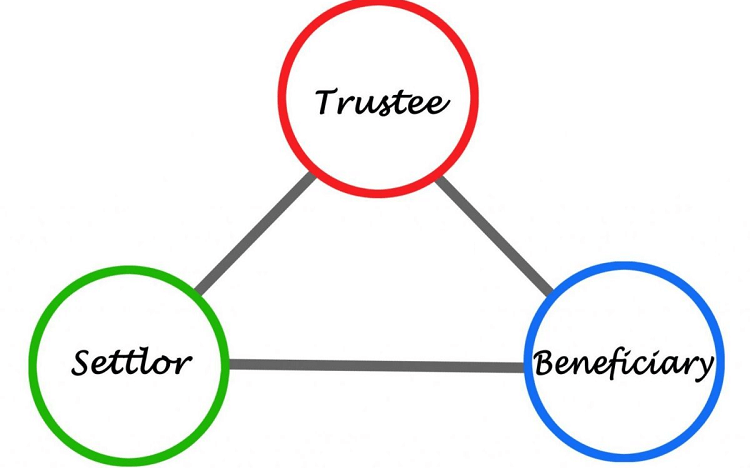

Recognizing Offshore Trusts: A Brief Introduction

When you take into consideration shielding your assets and preparing for the future, recognizing offshore counts on can be necessary. An overseas count on is a legal setup where you position your assets under the control of a trustee in a foreign territory. This arrangement permits you to handle your wealth while delighting in prospective advantages like decreased tax obligations and lawful defenses.

Developing an overseas trust fund typically includes choosing a reliable trustee and identifying the depend on's framework-- whether it's optional or dealt with. You'll require to determine what properties to consist of, such as actual estate, financial investments, or cash.

The key objective of an overseas depend on is to secure your properties from financial institutions, legal actions, or various other economic dangers. In addition, it can supply adaptability in exactly how and when your recipients receive their inheritance. By understanding these principles, you're far better outfitted to make enlightened choices concerning your monetary future.

Privacy Advantages of Offshore Counts On

Exactly how can offshore trusts boost your personal privacy? By establishing an overseas count on, you can effectively secure your possessions from public scrutiny. The trust framework permits you to keep ownership information personal, making sure that your personal information continues to be secured. This privacy can deter possible claims and lenders, giving you comfort.

In addition, lots of offshore territories have stringent personal privacy legislations that avoid unapproved access to trust fund info. This means that also if a person tries to investigate your financial events, they'll face substantial hurdles. You'll additionally take advantage of the discernment that comes with dealing with credible offshore experts who comprehend the importance of personal privacy in property management.

Additionally, overseas trusts can help you keep a low profile, as they usually operate outside the territory of your home country. By leveraging these privacy advantages, you can secure your riches and shield your legacy for future generations.

Tax Benefits and Implications

When thinking about overseas trust funds, you'll locate significant tax obligation benefits that can enhance your financial technique. However, it's critical to remain notified concerning compliance and regulations to prevent possible challenges. Understanding these aspects will assist you make the many of your overseas property monitoring.

Offshore Tax Obligation Conveniences

Many individuals and companies turn to overseas depends on for their tax obligation advantages, looking for to maximize their economic strategies. These trusts can offer considerable tax obligation advantages that aid you preserve wealth and enhance your financial placement. By putting your assets in an overseas count on, you might gain from lower tax obligation rates, prospective exceptions, or delayed tax obligations, depending upon the jurisdiction you choose. This setup can also protect your assets from tax obligations in your house nation, permitting higher growth potential. In addition, overseas depends on can produce chances for estate planning, guaranteeing your recipients get their inheritance with reduced tax implications. Inevitably, making use of these tax benefits can bring about an extra effective management of your assets and a more powerful monetary future.

Conformity and Rules

While offshore trust funds provide remarkable tax advantages, guiding through the compliance and regulatory landscape is important to taking full advantage of those advantages. You need to comprehend that various jurisdictions have special regulations concerning coverage and taxes. Staying compliant with these laws not only safeguards your properties yet also stops pricey penalties.

By remaining notified and compliant, you can totally leverage the tax obligation advantages of your offshore trust fund while safeguarding your financial future. Remember, the right approach can make all the distinction in reliable property monitoring.

Estate Preparation and Riches Conservation

When it pertains to estate planning and wealth preservation, overseas trust funds supply substantial advantages that can secure your possessions. By executing smart asset defense approaches, you can secure your riches from prospective risks and assure it profits your beneficiaries. Understanding these tools can aid you produce a solid prepare for your economic future.

Advantages of Offshore Counts On

Offshore depends on offer considerable benefits for estate planning and wealth conservation, specifically for those looking to safeguard their properties from possible risks. By putting your properties in an offshore count on, you can accomplish better privacy, as these counts on usually shield your estate from public scrutiny. In addition, overseas trust funds supply versatility in property monitoring, enabling you to dictate how and when possessions are dispersed.

Property Defense Strategies

Effective possession security techniques are necessary for safeguarding your wealth and guaranteeing it withstands for future generations. By using overseas depends on, you can develop a durable structure that guards your properties from lenders, suits, and potential financial risks. Developing a count on a jurisdiction with strong personal privacy regulations includes an added layer of security. Expanding your financial investments throughout different property courses also decreases threat, aiding to maintain your wide range. Consistently assessing and upgrading your estate strategy ensures it aligns with your lawful demands and current goals. In addition, looking for expert assistance can help you browse intricate guidelines and optimize the efficiency of your technique. By implementing these approaches, you can safeguard your monetary future and safeguard your legacy.

Possession Defense From Creditors and Legal Claims

While lots of people look for to expand their riches, protecting those possessions from creditors and lawful claims is similarly vital. Offshore depends on offer a powerful remedy for protecting your possessions. By putting your wide range in an offshore depend on, you develop a legal obstacle that can help protect your properties from potential claims, creditors, and other cases.

These trusts frequently run under favorable legislations that can make it hard for creditors to access your assets. When you develop an overseas trust fund, you're not simply securing your riches; you're additionally gaining assurance understanding your properties are secure.

Moreover, the privacy supplied by lots of offshore jurisdictions can prevent possible cases, as they may not even understand where your possessions are held. By proactively utilizing an overseas trust fund, you can guarantee your riches stays intact, permitting you to concentrate on development and future possibilities without Full Article the consistent worry of financial risks.

Investment Versatility and Diversity

When you spend with an overseas count on, you gain substantial adaptability and opportunities for diversity (offshore trust). Offshore counts on click to find out more enable you to access a larger series of financial investment alternatives, consisting of international markets and different properties that may be limited or less easily accessible domestically. This broadened reach enables you to tailor your portfolio according to your threat resistance and monetary objectives

Moreover, you can conveniently adjust your financial investment strategies in reaction to market conditions or personal scenarios. The capability to designate funds across various property courses-- like genuine estate, stocks, and bonds-- further boosts your possibility for growth while managing risk.

With reduced regulative constraints and more desirable tax obligation treatment in many overseas jurisdictions, you're empowered to maximize your investments. This adaptability not just helps in making best use of returns but likewise guards your properties from volatility, guaranteeing an extra steady financial future.

Picking the Right Offshore Count On Structure

Different kinds of frameworks, such as discretionary depends on or fixed counts on, supply unique advantages. Optional trusts offer adaptability in dispersing assets, while repaired depends on assure beneficiaries get fixed shares.

Often Asked Inquiries

Just how Do I Select a Trustee for My Offshore Trust?

To select a trustee for your offshore depend on, examine their know-how, credibility, and experience. Make sure they comprehend your objectives and interact successfully. Dependability and dependability are vital for handling and securing your possessions correctly.

Can Offshore Trusts Be Used for Charitable Objectives?

Yes, you can make use of overseas counts on for philanthropic functions. They enable you to sustain causes while gaining from tax obligation benefits and property security, guaranteeing your kind objectives straighten with your economic strategies efficiently.

What Are the Expenses Linked With Establishing up an Offshore Trust Fund?

Establishing an offshore trust entails various costs, blog here including legal costs, administrative charges, and possible taxes. You'll intend to allocate these costs to guarantee your trust fund is appropriately established and kept gradually.

Exactly how Do I Transfer Possessions Into an Offshore Depend On?

To move possessions into an offshore trust, you'll require to collect the essential documentation, complete the count on agreement, and officially move possession of the possessions, guaranteeing compliance with pertinent legislations and guidelines throughout the process.

If I Move Back to My Home Country?, what Takes place.

If you return to your home country, your offshore trust fund may deal with different tax obligation ramifications. You'll need to seek advice from lawful and tax professionals to recognize the prospective effects on your properties and depend on structure.

Verdict

To summarize, offshore trust funds use you a powerful means to improve your asset monitoring method. By prioritizing personal privacy, tax optimization, and durable possession defense, these depends on can help safeguard your riches for future generations. With customized estate planning and financial investment versatility, you can effectively browse the complexities of worldwide money. Selecting the appropriate overseas depend on structure allows you to maximize these benefits, guaranteeing your financial heritage remains undamaged and flourishing.

By positioning your assets in an offshore depend on, you could benefit from lower tax obligation prices, potential exemptions, or delayed tax obligation liabilities, depending on the jurisdiction you select. By positioning your properties in an offshore count on, you can accomplish better privacy, as these counts on usually shield your estate from public scrutiny. Furthermore, overseas trust funds provide flexibility in asset administration, allowing you to determine just how and when properties are dispersed. Various types of structures, such as discretionary counts on or taken care of trust funds, use unique benefits. Optional depends on supply flexibility in distributing assets, while fixed depends on guarantee recipients obtain fixed shares.

Report this page